Page 150 - รายงานประจำปี 2566

P. 150

Tokio Marine Safety Insurance (Thailand) Public Company Limited

Notes to the Financial Statements

Tokio Marine Safety Insurance (Thailand) Public Company Limited

For the year ended 31 December 2023

Notes to the Financial Statements

For the year ended 31 December 2023

7.11 Unexpired risk reserve

Unexpired risk reserve is calculated using an actuarial method, based on a best estimate of the

claims expected to incur over the remaining term of the insurance. Estimating the reserve

requires the management to exercise judgment, with reference to historical data and the best

estimates available at the time.

7.12 Liability adequacy test

At the end of each reporting period, the company assesses the adequacy of insurance liabilities

recognised in the financial position by comparing to the present value of the estimated future

cash flows from insurance contracts. If the assessment shows that the carrying amount of insurance

liabilities less related deferred acquisition cost is inadequate when compared to the estimated

future cash flows. The liabilities is increased by the deficiency and it is charged to profit or loss.

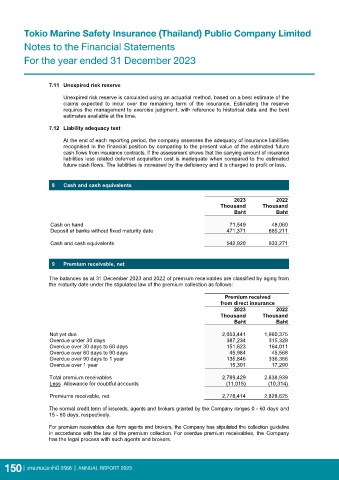

8 Cash and cash equivalents

2023 2022

Thousand Thousand

Baht Baht

Cash on hand 71,549 48,060

Deposit at banks without fixed maturity date 471,371 885,211

Cash and cash equivalents 542,920 933,271

9 Premium receivable, net

The balances as at 31 December 2023 and 2022 of premium receivables are classified by aging from

the maturity date under the stipulated law of the premium collection as follows:

Premium received

from direct insurance

2023 2022

Thousand Thousand

Baht Baht

Not yet due 2,053,441 1,960,375

Overdue under 30 days 387,234 315,329

Overdue over 30 days to 60 days 151,623 164,011

Overdue over 60 days to 90 days 45,984 45,568

Overdue over 90 days to 1 year 135,846 336,366

Overdue over 1 year 15,301 17,290

Total premium receivables 2,789,429 2,838,939

Less Allowance for doubtful accounts (11,015) (10,314)

Premiums receivable, net 2,778,414 2,828,625

The normal credit term of insureds, agents and brokers granted by the Company ranges 0 - 60 days and

15 - 60 days, respectively.

For premium receivables due form agents and brokers, the Company has stipulated the collection guideline

in accordance with the law of the premium collection. For overdue premium receivables, the Company

has the legal process with such agents and brokers.

150 | รายงานประจำาปี 2566 | ANNUAL REPORT 2023 33