Page 159 - รายงานประจำปี 2566

P. 159

Tokio Marine Safety Insurance (Thailand) Public Company Limited

Notes to the Financial Statements

Tokio Marine Safety Insurance (Thailand) Public Company Limited

For the year ended 31 December 2023

Notes to the Financial Statements

For the year ended 31 December 2023

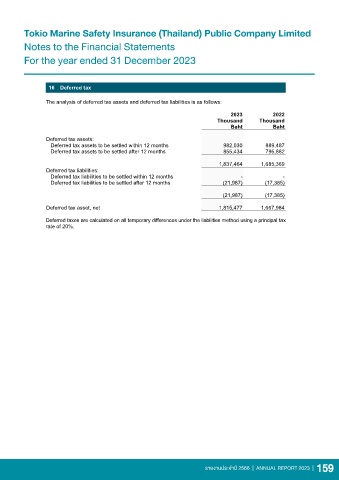

16 Deferred tax

The analysis of deferred tax assets and deferred tax liabilities is as follows:

2023 2022

Thousand Thousand

Baht Baht

Deferred tax assets:

Deferred tax assets to be settled within 12 months 982,030 889,487

Deferred tax assets to be settled after 12 months 855,434 795,882

1,837,464 1,685,369

Deferred tax liabilities:

Deferred tax liabilities to be settled within 12 months - -

Deferred tax liabilities to be settled after 12 months (21,987) (17,385)

(21,987) (17,385)

Deferred tax asset, net 1,815,477 1,667,984

Deferred taxes are calculated on all temporary differences under the liabilities method using a principal tax

rate of 20%.

42

รายงานประจำาปี 2566 | ANNUAL REPORT 2023 | 159