Page 171 - รายงานประจำปี 2566

P. 171

Tokio Marine Safety Insurance (Thailand) Public Company Limited

Notes to the Financial Statements

Tokio Marine Safety Insurance (Thailand) Public Company Limited

For the year ended 31 December 2023

Notes to the Financial Statements

For the year ended 31 December 2023

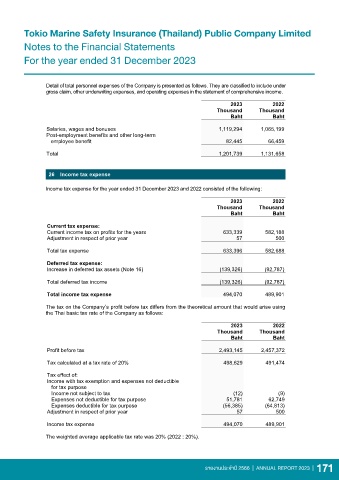

Detail of total personnel expenses of the Company is presented as follows. They are classified to include under

gross claim, other underwriting expenses, and operating expenses in the statement of comprehensive income.

2023 2022

Thousand Thousand

Baht Baht

Salaries, wages and bonuses 1,119,294 1,065,199

Post-employment benefits and other long-term

employee benefit 82,445 66,459

Total 1,201,739 1,131,658

26 Income tax expense

Income tax expense for the year ended 31 December 2023 and 2022 consisted of the following:

2023 2022

Thousand Thousand

Baht Baht

Current tax expense:

Current income tax on profits for the years 633,339 582,188

Adjustment in respect of prior year 57 500

Total tax expense 633,396 582,688

Deferred tax expense:

Increase in deferred tax assets (Note 16) (139,326) (92,787)

Total deferred tax income (139,326) (92,787)

Total income tax expense 494,070 489,901

The tax on the Company’s profit before tax differs from the theoretical amount that would arise using

the Thai basic tax rate of the Company as follows:

2023 2022

Thousand Thousand

Baht Baht

Profit before tax 2,493,145 2,457,372

Tax calculated at a tax rate of 20% 498,629 491,474

Tax effect of:

Income with tax exemption and expenses not deductible

for tax purpose

Income not subject to tax (12) (9)

Expenses not deductible for tax purpose 51,781 62,749

Expenses deductible for tax purpose (56,385) (64,813)

Adjustment in respect of prior year 57 500

Income tax expense 494,070 489,901

The weighted average applicable tax rate was 20% (2022 : 20%).

54

รายงานประจำาปี 2566 | ANNUAL REPORT 2023 | 171