Page 355 - Regional Comprehensive Economic Partnership (RCEP)

P. 355

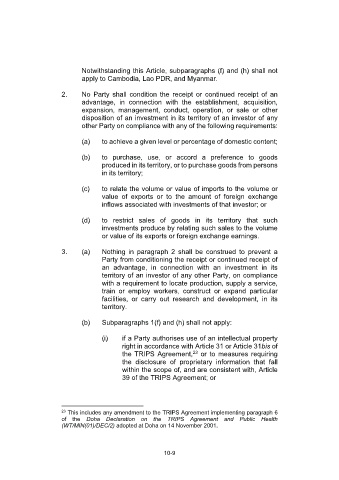

territory of an investor of any other Party, any of the following Notwithstanding this Article, subparagraphs (f) and (h) shall not

requirements: apply to Cambodia, Lao PDR, and Myanmar.

21

(a) to export a given level or percentage of goods; 2. No Party shall condition the receipt or continued receipt of an

advantage, in connection with the establishment, acquisition,

(b) to achieve a given level or percentage of domestic content; expansion, management, conduct, operation, or sale or other

disposition of an investment in its territory of an investor of any

(c) to purchase, use, or accord a preference to goods other Party on compliance with any of the following requirements:

produced in its territory, or to purchase goods from persons

in its territory; (a) to achieve a given level or percentage of domestic content;

(d) to relate the volume or value of imports to the volume or (b) to purchase, use, or accord a preference to goods

value of exports or to the amount of foreign exchange produced in its territory, or to purchase goods from persons

inflows associated with investments of that investor; in its territory;

(e) to restrict sales of goods in its territory that such (c) to relate the volume or value of imports to the volume or

investments produce by relating such sales to the volume value of exports or to the amount of foreign exchange

or value of its exports or foreign exchange earnings; inflows associated with investments of that investor; or

(f) to transfer a particular technology, a production process, or (d) to restrict sales of goods in its territory that such

other proprietary knowledge to a person in its territory; investments produce by relating such sales to the volume

or value of its exports or foreign exchange earnings.

(g) to supply exclusively from the territory of the Party the

goods that such investments produce to a specific regional 3. (a) Nothing in paragraph 2 shall be construed to prevent a

market or to the world market; or Party from conditioning the receipt or continued receipt of

an advantage, in connection with an investment in its

(h) to adopt a given rate or amount of royalty under a licence territory of an investor of any other Party, on compliance

contract, in regard to any licence contract in existence at with a requirement to locate production, supply a service,

the time the requirement is imposed or enforced, or any train or employ workers, construct or expand particular

future licence contract freely entered into between the facilities, or carry out research and development, in its

investor and a person in its territory, provided that the territory.

requirement is imposed or enforced in a manner that

constitutes direct interference with that licence contract by (b) Subparagraphs 1(f) and (h) shall not apply:

an exercise of non-judicial governmental authority of a

22

Party. For greater certainty, this subparagraph does not (i) if a Party authorises use of an intellectual property

apply when the licence contract is concluded between the right in accordance with Article 31 or Article 31bis of

23

investor and a Party. the TRIPS Agreement, or to measures requiring

the disclosure of proprietary information that fall

within the scope of, and are consistent with, Article

21 For greater certainty, each Party may maintain existing measures or adopt new or 39 of the TRIPS Agreement; or

more restrictive measures that do not conform with obligations under this Article, as set

out in List A and List B of its Schedule in Annex III (Schedules of Reservations and

Non-Conforming Measures for Services and Investment).

22 For the purposes of this subparagraph, a “licence contract” means any contract 23 This includes any amendment to the TRIPS Agreement implementing paragraph 6

concerning the licensing of technology, a production process, or other proprietary of the Doha Declaration on the TRIPS Agreement and Public Health

knowledge. (WT/MIN(01)/DEC/2) adopted at Doha on 14 November 2001.

10-8 10-9