Page 139 - รายงานประจำปี 2566

P. 139

Tokio Marine Safety Insurance (Thailand) Public Company Limited

Notes to the Financial Statements

Tokio Marine Safety Insurance (Thailand) Public Company Limited

For the year ended 31 December 2023

Notes to the Financial Statements

For the year ended 31 December 2023

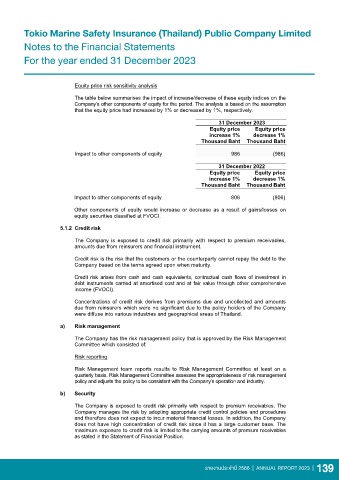

Equity price risk sensitivity analysis

The table below summarises the impact of increase/decrease of these equity indices on the

Company’s other components of equity for the period. The analysis is based on the assumption

that the equity price had increased by 1% or decreased by 1%, respectively.

31 December 2023

Equity price Equity price

increase 1% decrease 1%

Thousand Baht Thousand Baht

Impact to other components of equity 986 (986)

31 December 2022

Equity price Equity price

increase 1% decrease 1%

Thousand Baht Thousand Baht

Impact to other components of equity 806 (806)

Other components of equity would increase or decrease as a result of gains/losses on

equity securities classified at FVOCI.

5.1.2 Credit risk

The Company is exposed to credit risk primarily with respect to premium receivables,

amounts due from reinsurers and financial instrument.

Credit risk is the risk that the customers or the counterparty cannot repay the debt to the

Company based on the terms agreed upon when maturity.

Credit risk arises from cash and cash equivalents, contractual cash flows of investment in

debt instruments carried at amortised cost and at fair value through other comprehensive

income (FVOCI).

Concentrations of credit risk derives from premiums due and uncollected and amounts

due from reinsurers which were no significant due to the policy holders of the Company

were diffuse into various industries and geographical areas of Thailand.

a) Risk management

The Company has the risk management policy that is approved by the Risk Management

Committee which consisted of:

Risk reporting

Risk Management team reports results to Risk Management Committee at least on a

quarterly basis. Risk Management Committee assesses the appropriateness of risk management

policy and adjusts the policy to be consistent with the Company’s operation and industry.

b) Security

The Company is exposed to credit risk primarily with respect to premium receivables. The

Company manages the risk by adopting appropriate credit control policies and procedures

and therefore does not expect to incur material financial losses. In addition, the Company

does not have high concentration of credit risk since it has a large customer base. The

maximum exposure to credit risk is limited to the carrying amounts of premium receivables

as stated in the Statement of Financial Position.

22

รายงานประจำาปี 2566 | ANNUAL REPORT 2023 | 139