Page 142 - รายงานประจำปี 2566

P. 142

Tokio Marine Safety Insurance (Thailand) Public Company Limited

Notes to the Financial Statements

Tokio Marine Safety Insurance (Thailand) Public Company Limited

For the year ended 31 December 2023

Notes to the Financial Statements

For the year ended 31 December 2023

5.1.3 Liquidity risk

Liquidity risk, is the risk that the insurance company will encounter difficulty to settle the obligation

related to financial liabilities which must be settled in cash or other financial assets.

Prudent liquidity risk management implies maintaining sufficient cash and marketable securities

and the availability of funding through an adequate amount of committed credit facilities to meet

obligations when due and to close out market positions. At the end of the reporting period the

Company held deposits at call of Baht 471,371,300 (2022 : Baht 885,210,637) that are expected

to readily generate cash inflows for managing liquidity risk. Due to the dynamic nature of the

underlying businesses, the Company Treasury maintains flexibility in funding by maintaining

availability under committed credit lines.

a) Financing arrangements

The Company’s policy is to ensure that sufficient financial assets are available to meet

financial commitments by performing cash flow analysis regularly to ensure that cash

flows generated are sufficient so that financial commitments are met.

The Company’s financial assets mainly comprises of cash and deposits at financial

institutions and investment in securities. The management believes that such financial

assets will be able to be sold quickly at close to their fair value.

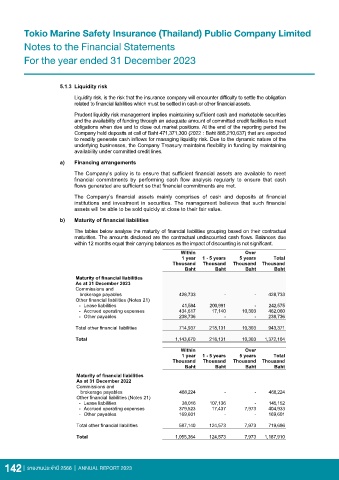

b) Maturity of financial liabilities

The tables below analyse the maturity of financial liabilities grouping based on their contractual

maturities. The amounts disclosed are the contractual undiscounted cash flows. Balances due

within 12 months equal their carrying balances as the impact of discounting is not significant.

Within Over

1 year 1 - 5 years 5 years Total

Thousand Thousand Thousand Thousand

Baht Baht Baht Baht

Maturity of financial liabilities

As at 31 December 2023

Commissions and

brokerage payables 428,733 - - 428,733

Other financial liabilities (Notes 21)

- Lease liabilities 41,584 200,991 - 242,575

- Accrued operating expenses 434,617 17,140 10,303 462,060

- Other payables 238,736 - - 238,736

Total other financial liabilities 714,937 218,131 10,303 943,371

Total 1,143,670 218,131 10,303 1,372,104

Within Over

1 year 1 - 5 years 5 years Total

Thousand Thousand Thousand Thousand

Baht Baht Baht Baht

Maturity of financial liabilities

As at 31 December 2022

Commissions and

brokerage payables 468,224 - - 468,224

Other financial liabilities (Notes 21)

- Lease liabilities 38,016 107,136 - 145,152

- Accrued operating expenses 379,523 17,437 7,973 404,933

- Other payables 169,601 - - 169,601

Total other financial liabilities 587,140 124,573 7,973 719,686

Total 1,055,364 124,573 7,973 1,187,910

142 | รายงานประจำาปี 2566 | ANNUAL REPORT 2023 25