Page 41 - Regional Comprehensive Economic Partnership (RCEP)

P. 41

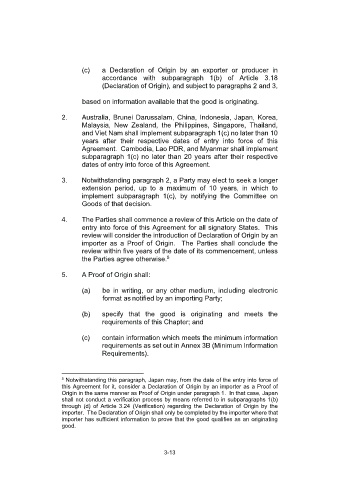

(b) the good has been transported through one or more (c) a Declaration of Origin by an exporter or producer in

Parties other than the exporting Party and the importing accordance with subparagraph 1(b) of Article 3.18

Party (hereinafter referred to as “intermediate Parties” in (Declaration of Origin), and subject to paragraphs 2 and 3,

this Article), or non-Parties, provided that the good:

based on information available that the good is originating.

(i) has not undergone any further processing in the

intermediate Parties or the non-Parties, except for 2. Australia, Brunei Darussalam, China, Indonesia, Japan, Korea,

logistics activities such as unloading, reloading, Malaysia, New Zealand, the Philippines, Singapore, Thailand,

storing, or any other operations necessary to and Viet Nam shall implement subparagraph 1(c) no later than 10

preserve it in good condition or to transport it to the years after their respective dates of entry into force of this

importing Party; and Agreement. Cambodia, Lao PDR, and Myanmar shall implement

subparagraph 1(c) no later than 20 years after their respective

(ii) remains under the control of the customs authorities dates of entry into force of this Agreement.

in the intermediate Parties or the non-Parties.

3. Notwithstanding paragraph 2, a Party may elect to seek a longer

2. Compliance with subparagraph 1(b) shall be evidenced by extension period, up to a maximum of 10 years, in which to

presenting the customs authorities of the importing Party either implement subparagraph 1(c), by notifying the Committee on

with customs documents of the intermediate Parties or the non- Goods of that decision.

Parties, or with any other appropriate documentation on request

of the customs authorities of the importing Party. 4. The Parties shall commence a review of this Article on the date of

entry into force of this Agreement for all signatory States. This

3. Appropriate documentation referred to in paragraph 2 may review will consider the introduction of Declaration of Origin by an

include commercial shipping or freight documents such as airway importer as a Proof of Origin. The Parties shall conclude the

bills, bills of lading, multimodal or combined transport documents, review within five years of the date of its commencement, unless

a copy of the original commercial invoice in respect of the good, the Parties agree otherwise.

5

financial records, a non-manipulation certificate, or other relevant

supporting documents, as may be requested by the customs 5. A Proof of Origin shall:

authorities of the importing Party.

(a) be in writing, or any other medium, including electronic

format as notified by an importing Party;

SECTION B

OPERATIONAL CERTIFICATION PROCEDURES (b) specify that the good is originating and meets the

requirements of this Chapter; and

Article 3.16: Proof of Origin (c) contain information which meets the minimum information

requirements as set out in Annex 3B (Minimum Information

1. Any of the following shall be considered as a Proof of Origin: Requirements).

(a) a Certificate of Origin issued by an issuing body in

accordance with Article 3.17 (Certificate of Origin); 5 Notwithstanding this paragraph, Japan may, from the date of the entry into force of

this Agreement for it, consider a Declaration of Origin by an importer as a Proof of

(b) a Declaration of Origin by an approved exporter in Origin in the same manner as Proof of Origin under paragraph 1. In that case, Japan

accordance with subparagraph 1(a) of Article 3.18 shall not conduct a verification process by means referred to in subparagraphs 1(b)

(Declaration of Origin); or through (d) of Article 3.24 (Verification) regarding the Declaration of Origin by the

importer. The Declaration of Origin shall only be completed by the importer where that

importer has sufficient information to prove that the good qualifies as an originating

good.

3-12 3-13