Page 313 - Regional Comprehensive Economic Partnership (RCEP)

P. 313

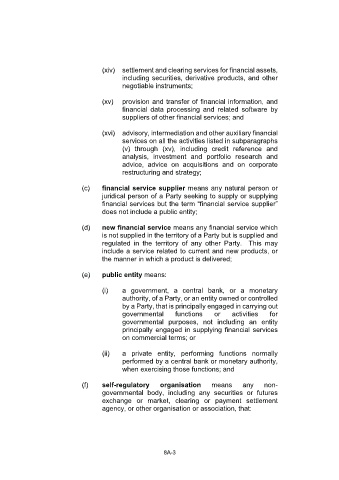

(vi) lending of all types, including consumer credit, (xiv) settlement and clearing services for financial assets,

mortgage credit, factoring, and financing of including securities, derivative products, and other

commercial transaction; negotiable instruments;

(vii) financial leasing; (xv) provision and transfer of financial information, and

financial data processing and related software by

(viii) all payment and money transmission services, suppliers of other financial services; and

including credit, charge and debit cards, travellers

cheques, and bankers drafts; (xvi) advisory, intermediation and other auxiliary financial

services on all the activities listed in subparagraphs

(ix) guarantees and commitments; (v) through (xv), including credit reference and

analysis, investment and portfolio research and

(x) trading for own account or for account of customers, advice, advice on acquisitions and on corporate

whether on an exchange, in an over-the-counter restructuring and strategy;

market or otherwise, the following:

(c) financial service supplier means any natural person or

(A) money market instruments (including juridical person of a Party seeking to supply or supplying

cheques, bills, certificates of deposits); financial services but the term “financial service supplier”

does not include a public entity;

(B) foreign exchange;

(d) new financial service means any financial service which

(C) derivative products including futures and is not supplied in the territory of a Party but is supplied and

options; regulated in the territory of any other Party. This may

include a service related to current and new products, or

(D) exchange rate and interest rate instruments, the manner in which a product is delivered;

including products such as swaps and

forward rate agreements; (e) public entity means:

(E) transferable securities; and (i) a government, a central bank, or a monetary

authority, of a Party, or an entity owned or controlled

(F) other negotiable instruments and financial by a Party, that is principally engaged in carrying out

assets, including bullion; governmental functions or activities for

governmental purposes, not including an entity

(xi) participation in issues of all kinds of securities, principally engaged in supplying financial services

including underwriting and placement as agent on commercial terms; or

(whether publicly or privately) and provision of

services related to such issues; (ii) a private entity, performing functions normally

performed by a central bank or monetary authority,

(xii) money broking; when exercising those functions; and

(xiii) asset management, such as cash or portfolio (f) self-regulatory organisation means any non-

management, all forms of collective investment governmental body, including any securities or futures

management, pension fund management, custodial, exchange or market, clearing or payment settlement

depository, and trust services; agency, or other organisation or association, that:

8A-2 8A-3