Page 127 - PEA_AnnualReport_2016

P. 127

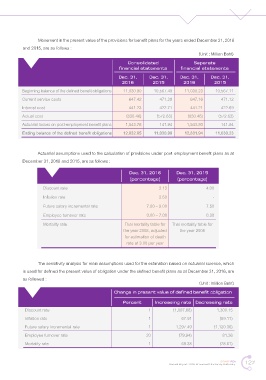

ovement in the present value of the provisions for beneft plans for the years ended ecember 31, 2016

and 2015, are as follows :

(Unit : Million Baht)

Consolidated Separate

financial statements financial statements

Dec. 31, Dec. 31, Dec. 31, Dec. 31,

2016 2015 2016 2015

eginning balance of the defned beneft obligations 11,030.90 10,567.49 11,030.23 10,567.11

Current service costs 647.42 471.39 647.16 471.12

Interest cost 441.23 422.71 441.21 422.69

Actual cost (830.46) (572.63) (830.46) (572.63)

ctuarial losses on post-employment beneft plans 1,543.76 141.94 1,543.80 141.94

n ing a an o t fin n fit o igations 12,832.85 11,030.90 12,831.94 11,030.23

ctuarial assumptions used to the calculation of provisions under post employment beneft plans as at

December 31, 2016 and 2015, are as follows :

Dec. 31, 2016 Dec. 31, 2015

(percentage) (percentage)

Discount rate 3.13 4.00

Infation rate 2.50 -

Future salary incremental rate 7.00 – 9.00 7.50

Employee turnover rate 0.00 – 7.00 0.30

Mortality rate Thai mortality table for Thai mortality table for

the year 2008, adjusted the year 2008

for estimation of death

rate at 3.00 per year

The sensitivity analysis for main assumptions used for the estimation based on actuarial science, which

is used for defned the present value of obligation under the defned beneft plans as at ecember 31, 2016, are

as followed :

(Unit : Million Baht)

Change in present value of defined benefit obligation

Percent Increasing rate Decreasing rate

Discount rate 1 (1,097.68) 1,300.15

Infation rate 1 67.91 (59.11)

Future salary incremental rate 1 1,297.49 (1,120.36)

Employee turnover rate 20 (79.94) 81.36

Mortality rate 1 69.38 (78.61)

SMART PEA 127

Annual Report 2016 Provincial Electricity Authority