Page 209 - SUSTAINABILITY REPORT 2020

P. 209

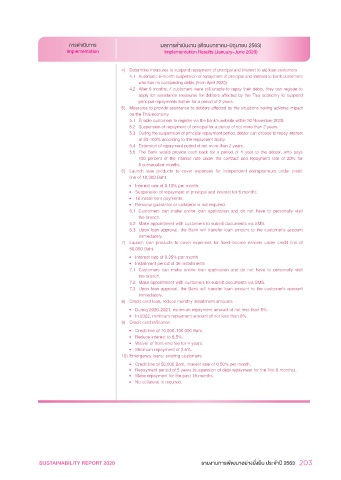

การดำาเนินการ ผลการดำาเนินงาน (เดือนมกราคม-มิถุนายน 2563)

Implementation Implementation Results (January-June 2020)

4) Determine measures to suspend repayment of principal and interest to aid loan customers

4.1 Automatic 6-month suspension of repayment of principal and interest to bank customers

who has no outstanding debts (from April 2020).

4.2 After 6 months, if customers were still unable to repay their debts, they can register to

apply for assistance measures for debtors affected by the Thai economy to suspend

principal repayments further for a period of 2 years.

5) Measures to provide assistance to debtors affected by the situations having adverse impact

on the Thai economy

5.1 Enable customers to register via the bank's website within 30 November 2020.

5.2 Suspension of repayment of principal for a period of not more than 2 years.

5.3 During the suspension of principal repayment period, debtor can choose to repay interest

at 50-100% according to the repayment ability.

5.4 Extension of repayment period of not more than 2 years.

5.5 The Bank would provide cash back for a period of 1 year to the debtor, who pays

100 percent of the interest rate under the contract and repayment rate of 20% for

6 consecutive months.

6) Launch loan products to cover expenses for independent entrepreneurs under credit

line of 10,000 Baht

• Interest rate of 0.10% per month.

• Suspension of repayment of principal and interest for 6 months.

• 18 installment payments.

• Personal guarantor or collateral is not required.

6.1 Customers can make online loan application and do not have to personally visit

the branch.

6.2 Make appointment with customers to submit documents via SMS.

6.3 Upon loan approval, the Bank will transfer loan amount to the customer's account

immediately.

7) Launch loan products to cover expenses for fixed-income earners under credit line of

50,000 Baht.

• Interest rate of 0.35% per month

• Installment period of 36 installments

7.1 Customers can make online loan application and do not have to personally visit

the branch.

7.2 Make appointment with customers to submit documents via SMS.

7.3 Upon loan approval, the Bank will transfer loan amount to the customer's account

immediately.

8) Credit card loan, reduce monthly installment amounts

• During 2020-2021, minimum repayment amount of not less than 5%.

• In 2022, minimum repayment amount of not less than 8%.

9) Credit card refinance

• Credit line of 10,000-100,000 Baht.

• Reduce interest to 8.5%.

• Waiver of front-end fee for 4 years.

• Minimum repayment of 2.5%.

10) Emergency loans: existing customers

• Credit line of 50,000 Baht, interest rate of 0.50% per month.

• Repayment period of 5 years (suspension of debt repayment for the first 6 months).

• Make repayment for the past 18 months.

• No collateral is required.

GSB SOCIAL BANK SUSTAINABILITY REPORT 2020 รายงานการพัฒนาอย่างยั่งยืน ประจำาปี 2563 203