Page 69 - SUSTAINABILITY REPORT 2020

P. 69

The global sustainable development issue, which has been continuously affecting the economy, society and

environment, is an important challenge in the sustainable development of all countries. The financial institution sector

is an important sector which received much anticipation from the society to change its operating roles, including

providing supports to various business organizations, taking into account business operations that are responsible for

the environment, society and governance, as well as to drive other sectors to conduct their operations in the direction

that leads to more sustainable and efficient development.

The Bank of Thailand (BOT), as regulator of financial institutions, recognizes the importance of sustainability

and, therefore, prescribes sustainability issues in the 2020-2022 strategic plan. The BOT stated that, in running their

operations, financial institutions have to consider sustainability in aspects of environmental, social and governance

and set up a policy to support the Thai financial institution system to realize and place emphasis on the principles of

sustainable banking under the concept of “Sustainable Finance”.

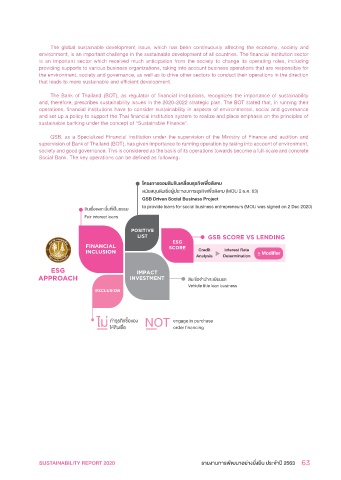

GSB, as a Specialized Financial Institution under the supervision of the Ministry of Finance and audition and

supervision of Bank of Thailand (BOT), has given importance to running operation by taking into account of environment,

society and good governance. This is considered as the basis of its operations towards become a full-scale and concrete

Social Bank. The key operations can be defined as following:

โครงการออมสินขับเคลื่อนธุรกิจเพื่อสังคม

สนับสนุนสินเชื่อผู้ประกอบการธุรกิจเพื่อสังคม (MOU 2 ธ.ค. 63)

GSB Driven Social Business Project

สินเชื่อดอกเบี้ยที่เป็นธรรม to provide loans for social business entrepreneurs (MOU was signed on 2 Dec 2020)

Fair interest loans

POSITIVE

LIST GSB SCORE VS LENDING

ESG

FINANCIAL SCORE

INCLUSION Credit Interest Rate + Modifier

Analysis Determination

ESG IMPACT

APPROACH INVESTMENT สินเชื่อจำานำาทะเบียนรถ

Vehicle title loan business

EXCLUSION

ไม่ ทำาธุรกิจซื้อของ NOT engage in purchase

ให้สินเชื่อ

order financing

GSB SOCIAL BANK SUSTAINABILITY REPORT 2020 รายงานการพัฒนาอย่างยั่งยืน ประจำาปี 2563 63